Income Fund Update - Q3 2024

Hello Partners,

I hope this update finds you well.

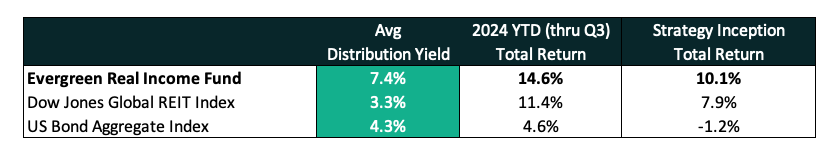

The average distribution yield YTD is 7.4%.

Here are the YTD & historical returns for the Income Fund though Q3.

Private real estate is showing clear signs of recovery after years of uncertainty. Recent developments, particularly the Federal Reserve's shift towards a more accommodative monetary policy, are creating a more favorable environment for real estate investors.

This shift tends to support higher valuations, reduce refinancing costs, stimulate transactions, and enhance the attractiveness of real estate cash flow yields compared to declining bond rates.

Apparently there was also an election in the US last week. You probably heard about it.

Tough to say how a Trump administration will impact real estate. Oddsmakers would likely say they’ll be a net positive to real assets. I would tend to agree, but there are a TON of variables at play (GDP growth, lower taxes, bonus depreciation extension, tariffs, dollar strength, steepening of yield curve, regulatory easing, etc).

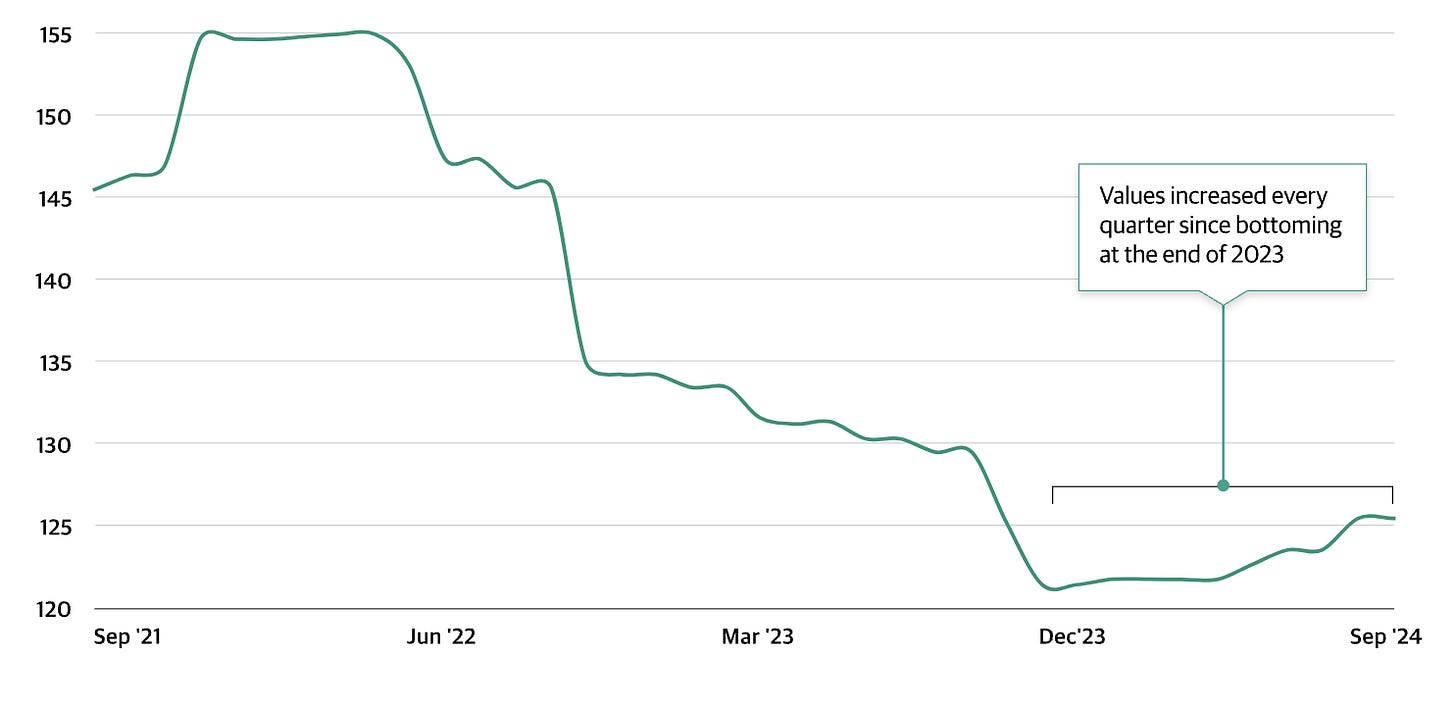

Either way, real estate values seem to have bottomed.

Real Estate Recovery is Emerging

Green Street U.S. Commercial Property Price Index1

Unlike previous real estate downturns, the current market is characterized by several positive fundamental factors. As previously detailed, REIT leverage still remains extremely low (on a relative basis) with ratios at around 5.5 times cash flow, compared to over 8.5 times during the 2007-2008 financial crisis.

New construction has been limited due to high costs, creating a supply shortage in both commercial and residential sectors. Many property types, including apartments, warehouses, and single-family rentals, are enjoying high occupancy rates above 90%.

These factors suggest the real estate recovery could be faster than in past cycles. The combination of constrained supply and steady demand is likely to support rent growth and property appreciation in the coming years. High-quality properties in strong locations should outperform.

On the public side, REITs are trading at a significant discount to the broader stock market, with the valuation gap approaching 20-year highs according to Green Street Advisors.

Segment Highlight: Build-to-Rent

The build-to-rent (BTR) sector has emerged as a new and rapidly growing asset class. As housing affordability challenges persist and demographic shifts continue, BTR properties are filling a crucial gap in rental markets.

What is Build-to-Rent?

BTR properties are new housing communities designed specifically for long-term renters. These developments typically consist of 50 or more single-family homes or townhomes, offering the privacy and space of traditional homes without the responsibilities (and high costs) of homeownership.

BTR Demand Tailwinds

Key Features of BTR Communities:

Professional Management: Unlike scattered rental properties, BTR communities are largely owned by institutional investors (like Invitation Homes) and are professionally managed, providing consistent maintenance and service.

Location: BTR communities are often built in suburban edges, balancing space with shorter commute times.

Amenities: Many BTR developments offer shared amenities like pools, fitness centers and parks.

Design: Units are built with renters in mind, featuring durable / affordable materials and layouts that cater to modern lifestyles.

Why BTR is Gaining Traction

Several factors are driving the growth of the BTR sector:

Demographic Shifts: Millennials entering family-formation years and empty nesters seeking flexibility are prime targets for BTR housing.

Affordability Challenges: Rising home prices have made renting an attractive option for many who desire single-family living.

Lifestyle Preferences: BTR offers tremendous flexibility vs. locking into a 30 year mortgage.

Market Outlook

The BTR market is expected to grow significantly in the coming years. CBRE projects that the current inventory of about 350,000 units could increase by nearly 50% in the near future. This growth is supported by a national housing shortage of approximately 3 to 4 million homes (depending on who you ask).

Investment Considerations

For investors, BTR offers several advantages:

Lower Turnover: Residents in BTR homes tend to stay longer than traditional apartment renters.

Higher Rental Rates: BTR properties can command premium rents compared to standard apartments.

Operational Efficiencies: Professional management and purpose-built designs can lead to more efficient operations. They are far easier to run vs. a random portfolio of homes spread across a major city.

Conclusion

As the market continues to mature, BTR is poised to play an increasingly important role in addressing housing needs and shaping suburban development patterns.

We are short-term bullish on the sector given the incredibly affordability gap between buying vs. renting. We currently own both Invitation Homes and AMH in the portfolio as of today.

Thank you,

Evergreen Capital

Green Street Advisors, as of September 30, 2024. Reflects the Commercial Property Price Index for All Property, which captures the prices at which U.S. commercial real estate transactions are currently being negotiated and contracted.