Income Fund Update - Q2 2022

Hello Partners,

Hope this update finds you well.

The average annualized distribution yield YTD is 9.1%.

Below are the full returns (through 6.30.22) for the Income Fund.

As you probably know, the S&P 500 is in a bear market. It ended the first half the year down 20.6%, which was the worst start to a year since 1962. Publicly traded real estate fared just as poorly.

The good news is our Income Fund has outperformed the REIT index thus far (-15% vs. -21%). We’re ahead of our long-term goal: to generate 2-3X the income while still beating the index over 3 year rolling periods.

Market Color

The first half of 2022 was dominated by rising rates and inflation. This resulted in a multiple reduction across nearly all assets. Hypothetical (future) earnings are simply less valuable than they were in 2021.

The less certain the profits, the higher the pain (plenty of unprofitable tech stocks are down 80%+).

So if the first half was about mean reversion the 2nd half will likely be about earnings quality. In other words, technology firms that had artificially high, stimulus-boosted earnings are probably due for further declines.

But companies that can grow earnings into possible economic headwinds should materially outperform - at least on a relative basis.

REIT Health

Thankfully, real estate fundamentals still look great. Leasing, occupancy and rent growth are still tracking at or above expectations for most of our REIT holdings.

Additionally, the recent increase in interest rates is less impactful for REITs than for private real estate operators. REITs use far less leverage to begin with and the best management teams spent the last decade improving their balance sheets.

REIT leverage is at its lowest level in recent history.

REITs have record low debt (at sub 3% rates) locked till 2030. Not a bad starting position going into an inflationary environment.

Many REITs will be operating from a position of strength (relative to private market operators) for the foreseeable future.

Consequently, while I have no idea where the REIT market will go from here, this is nothing like 2008. Our REITs don’t have an existential debt threat. They can weather a recession without having to rely on the kindness of strangers (bankers).

Sector Focus

High energy prices, depressed consumer sentiment, Fed tightening, and negative feedback from the bear market certainly suggest a recession on the horizon (or is already here).

How much of that possible downturn is already “priced in” is unknown.

Therefore the key is determining what REITs will sustain earnings growth and which are likely to stall or produce less cash flow than expected. Thankfully, pricing power is what we tend to focus on anyways.

Regardless, it’s probably prudent to be a bit defensive today with above average exposure to recession-resistant sectors such as medical office, manufactured housing, apartments and infrastructure, which is exactly what we’ve done.

Office Pain

A small part of our outperformance this year is attributable to our active underweight of the office sector. It’s small because office REITs only make up about 4% of the REIT index.

As of today we have zero exposure to traditional office and were at one point short ~5% office in Q2 (via several coastal office REITs). This was a profitable strategy that we use sparingly given this is an income focused fund.

Of course, this was not a difficult call for anyone tracking office attendance and talking to leasing brokers and property owners.

Office availability is exploding. More than 200 million square feet of office space has become available since the end of 2019 while the number of office-using employees (most of who are still working from home) has been roughly stable at ~21 million.

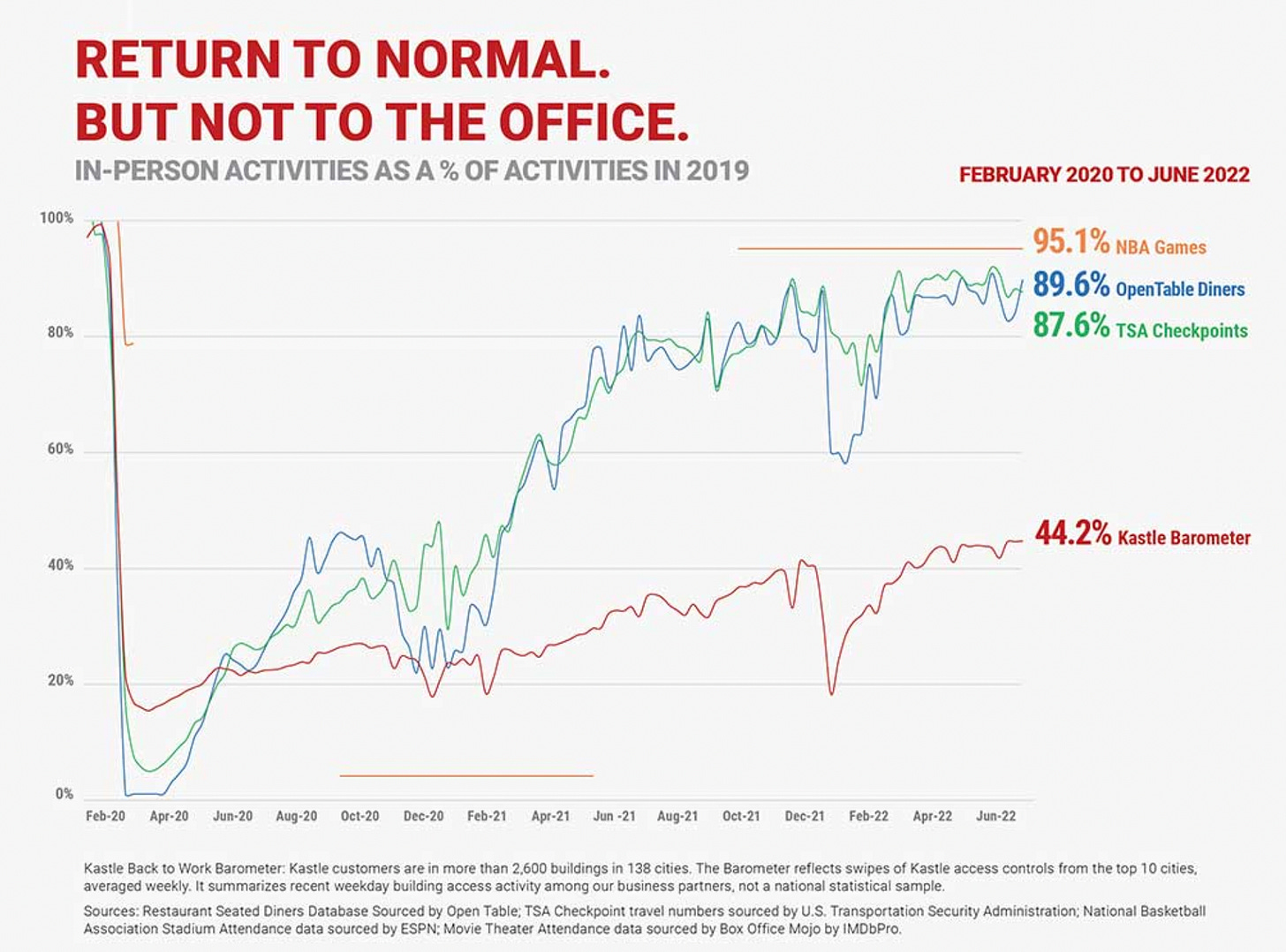

The world has put COVID in the rearview. Attendance at restaurants, sporting events and even airports is almost back to normal.

Yet office attendance is a sad 44% according to Kastle Systems, an office security firm with employee keycard access data.

If unemployment increases meaningful (which the Fed seems to want), the power dynamic could shift back to employers. This may or may not jolt employees back to the office. Regardless, WFH is ideal for many roles and plenty of employers seems to be embracing it. Therefore, it seems probable that February 2020 could have been “peak office”.

The public markets are starting to reflect that viewpoint. The average office REIT is now down 25% for the year and is trading at an effective 7% cap rate. Several NYC office REITs are at ~9% cap rates. Ouch.

Commodity Office vs. Trophy

If the WFH trend doesn’t reverse soon, older or “commodity” office properties are in trouble.

For example - in San Francisco, the vacancy rate among Class C buildings (older buildings) is already 37.2 percent vacant1. Class A is only 11.9%.

The best of the best (ex: Boston Properties) have mostly trophy assets and should be fine over the long term. However, plenty of office assets will be slogging through the next few years as current leases expire.

This should lead to either a) locking in much lower rents or worse b) increasing vacancy. Even small vacancy spikes can mean death in office. Not just for the obvious lack of rent. Re-leasing capital tends to be the real killer.

Office owners have to spend crazy amounts of capital - always up front and sometimes on spec - to attract the best tenants (construction allowances, new lobby redesigns, broker commissions, green retrofits to reduce emissions, etc).

If you don’t have a large balance sheet, what do you do when you need to come up with releasing capital when your office asset is struggling? Not many lenders are going to want to play white knight in this scenario.

Unless office usage quickly recovers, a staggering number of buildings will become melting ice cubes that need to be repurposed.

REIT Valuations

Most REIT sectors are trading at a 15% - 25% discount to private market valuations despite generating record cash flow growth and paying out large dividends.

This could mean one of two things.

Private real estate is due for a meaningful haircut. I am starting to hear about deals falling out of contract, which is a reliable signal for future price discounts.

Or… public REITs have diverged from private market pricing due to overall investor sentiment and should realign with their private market peers.

“True” market value is probably somewhere in the middle of these two outcomes. Regardless, listed REITs currently have lower leverage, higher quality assets and cheaper valuations. They look compelling relative to private real estate today.

If only we knew the precise moment when REIT pricing will catch up to the underlying property cash flows.

Best,

Brad Johnson

530 Technology Drive | Suite 100 | Irvine, California 92618 | www.evergreencap.com

https://therealdeal.com/sanfrancisco/2022/07/07/san-francisco-office-vacancies-up-across-board/